Solar is in the process of shearing off the base of the entire global industrial stack – energy – and the tech sector still lacks a unified thesis for how to best enable, accelerate, and exploit this transition. There is a bitter lesson here – solar is all you need.

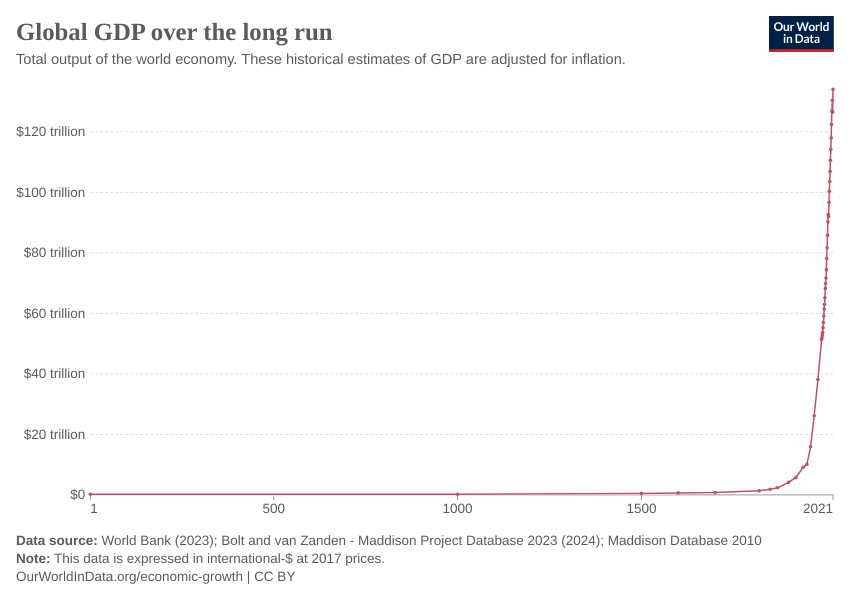

Modern humans evolved perhaps 200,000 years ago, and for the 10,000 intervening generations between then and now, endured 100 billion mostly short, poverty stricken, ignorant, and fearful lifetimes.

Our current time is so different from even the lives of our grandparents that it is difficult to make a comparison, but clearly something has changed.

To a good approximation, even as global population climbs towards 10 billion, the number of humans enduring extreme poverty has fallen in both absolute and relative terms, from nearly universal just 200 years ago to rapidly vanishing today. We are living in the first time in the history of any life form where we can put a finite upper bound on the number of poverty-stricken human years left to be endured by the human race: Almost certainly fewer than 10 billion. This is a lot but it’s a lot fewer than infinity.

This unprecedented improvement in the human condition has been unlocked by social and political innovation, and underwritten by the consumption of copious quantities of cheap energy, almost all of it from fossil coal, oil, and gas.

To a good approximation, oil is the antidote to poverty.

Oil is finite. The good stuff is gone. Fracking is expensive. Most places don’t have oil. Climate and scarcity will force us to use other forms of energy, most of them not as useful as oil. Are we headed for economic difficulties as a result of this? A handful of nations have endured severe energy shortages due to political instability, and it has never gone well for them. North Korea. Cuba. Venezuela. Are we doomed?

No.

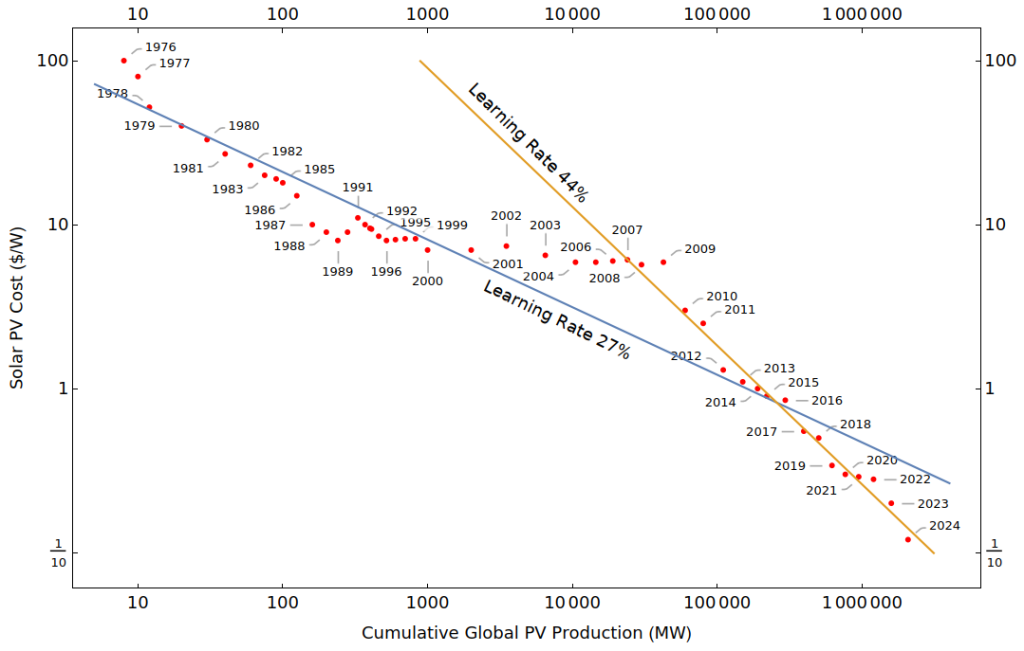

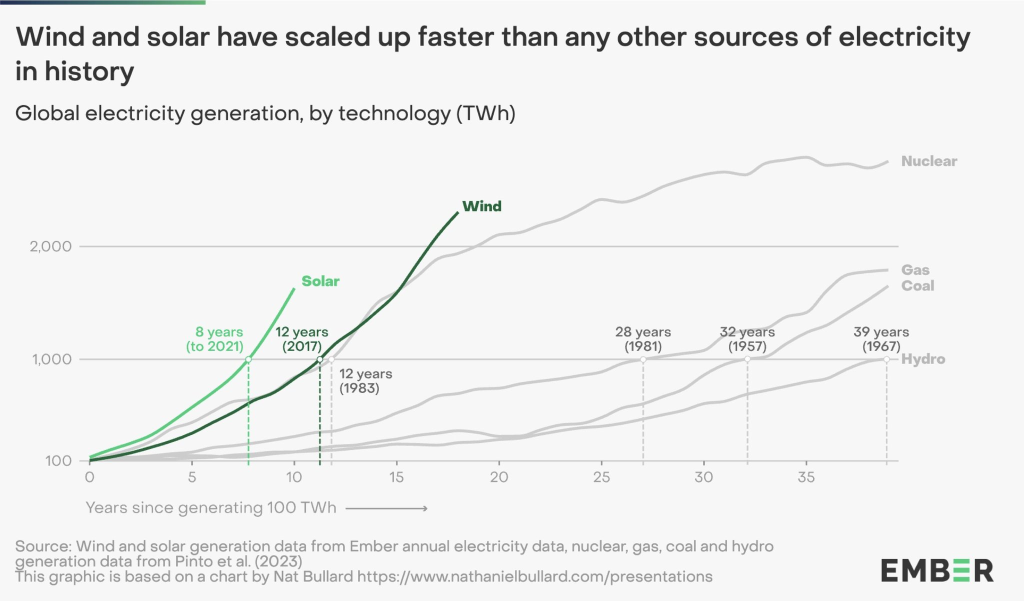

Solar photovoltaic (PV) power got cheap, then big, then cheaper, then bigger. Last year, we installed about 460 GW globally.

Check out the knee in the curve in 2009! A learning rate of 44% means that the cost falls by 44% for every doubling of production, and production is currently doubling roughly every 18 months.

Here’s a free heretical viewpoint, or at least an early prediction.

Solar PV is not just a partial substitute for oil, it’s a cheaper and better energy source in every way that matters.

Corollary: Our techno-capital machine is a thermodynamic mechanism that systematically hunts for and then maximally exploits the cheapest energy it can find. When it unlocks cheaper energy, first coal, then oil, then gas, and now solar, it drives up the rate of economic growth, due to an expanded spread between energy cost and application value.

In other words, we’re now about a decade into a three decade process (the ~sixth industrial revolution) where the entire world economy and its industrial stack is eagerly switching to solar PV as its preferred source of cheap energy, creating enormous value.

Strangely, despite this being a locked-in inevitability, I am yet to see a rigorous, unified and broad-based investment thesis formulated to capture durable long term sources of value in the new economy now frantically constructing itself. In just the last few years, we’ve seen passing fads of investment in autonomous driving, VR, fusion, crypto/web3, and AI, all built on an as-yet-unrealized conviction that these technologies would create winner-take-most companies that would become as fundamental to our way of life as Google or Amazon. Yet the companies and industries that underlie our entire way of life are on a fast track to disruption from below, providing the first opportunity in a century, and probably the last opportunity ever, to rewrite the rule book and ownership structure of the world of atoms.

For the remainder of this post, I’m going to lay out my most comprehensive list yet of the industrial applications of cheap energy, together with a prescription for their transition to solar as a fundamental source of energy, and estimates of their economic value. Almost all these require hardware innovation in heavy industry – the industry we should all aspire to work on.

I think it makes sense to loosely group applications by type of process. Solar PV transforms solar energy in the form of light into direct current (DC) electricity during the day. The Earth receives about 173,000 TW continuously, more than 10,000x humanity’s current needs.

This DC electricity can be used in that form, transformed to alternating current (AC) to power the grid, transformed into thermal energy using resistive heaters, split water into hydrogen and oxygen using electrolysis, or perform other electrocatalytic processes. With relatively minimal equipment, it’s possible to transfer solar PV DC into synthetic fuels which are backwards compatible with all the fossil fuel infrastructure we already have. This approach, which minimizes the cost of gradually shifting hydrocarbon supply over to cheaper, chemically identical drop-in synthetic substitutes, consumes the bulk of my time at Terraform Industries. We are hiring!

Some end uses are so expensive (e.g. large data centers) that it is economically compelling to use large battery systems to smooth out the power to run 24 hours per day, 7 days per week. Other end uses are so power intensive and cost sensitive (eg synthetic fuels, cement production) that batteries are cost prohibitive and solar applications must adapt to intermittent power production. Intermittent adaptation requires only two innovations: Lower capex due to lower utilization, and a throttle-able process that can time-match power availability.

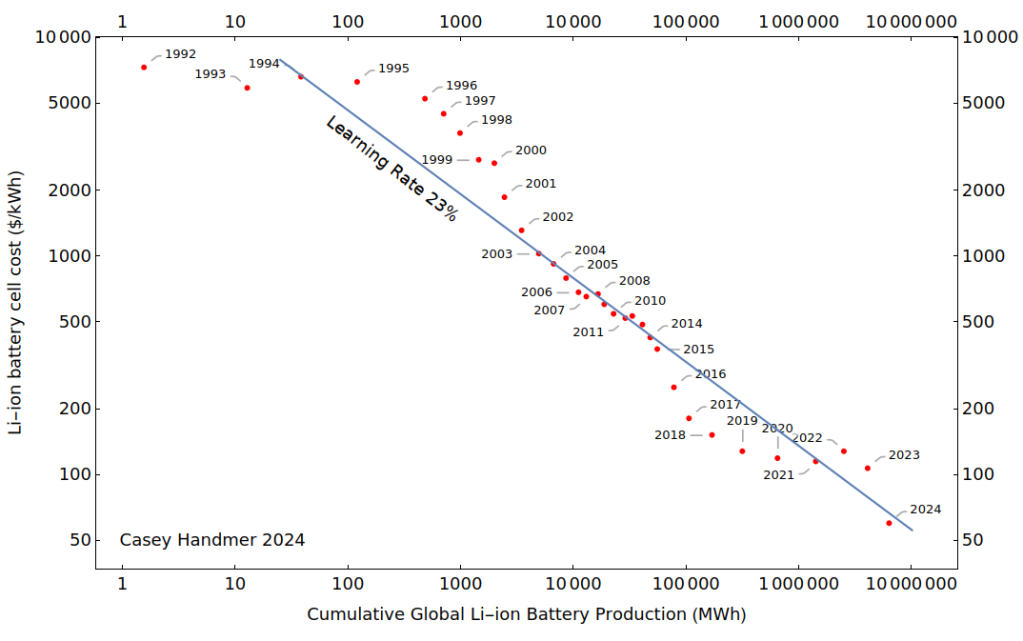

DC electricity

- AI data centers. $300b, 10% growth. While it is uncertain exactly how much compute we need to saturate demand, current LLM capabilities already require significantly more electricity to scale than can be provided by the grid or even newly built gas or nuclear power plants, primarily due to supply chain constraints on steam turbines. The next generation of gigawatt-scale data centers will have to be powered, therefore, by solar and batteries, which are on their own precipitous cost decline and explosive growth curve (shown below). Even at current prices, the cost of a GW-scale solar plant and a big enough battery for 99.9% up time is ~5% of the cost of the GPUs and racking hardware. The only siting constraint is land – about 20,000 acres or 31 square miles.

- Solar desalination. $30b 10% growth. Our agricultural systems depend on natural river flow for cheap irrigation, and many of the world’s rivers are faltering. For less than one cent on the dollar, we can build our own artificial rivers to safeguard our food supply and reduce stress on river ecosystems, all while reducing cost and complexity of legacy irrigation infrastructure. Many people are saying this. In the case of Southern California, we can double our supply from the Colorado, build a global-scale light metal processing industry, and fix the Salton Sea for just $5b/year over 10 years, and that’s without any further improvements in technology or cost.

- Environmental and ecological restoration. $1t in land value appreciation over 10 years in CA alone. Why stop at the Salton Sea? A whole bunch of intractable ecological problems, unsolvable in a condition of energy scarcity, can be solved as a byproduct of newly scaled solar PV-based industries. In California, we can restore the Owens Lake and Owens Valley to its pre-scarcity water abundance. We can use the dams on the lower Colorado to enable more irrigation further upstream, including in Arizona and Nevada, two states that enjoyed lush temperate climates less than 10,000 years ago, before the end of the ice age transformed them into incredibly harsh deserts. Internationally, most rivers remain under enormous pressure and the Aral Sea is almost completely gone. Solar desalination and industry provides the water, labor, and capital to re-cultivate most of the world’s brown fields.

- Antimatter production. $10^19 at current energy prices. Antimatter is the most energy-dense fuel we know of, and will almost certainly be necessary for interstellar travel. Producing it currently is incredibly expensive and energy intensive. When we need to produce vast quantities of antimatter to fly to nearby stars, it will almost certainly be in solar powered particle accelerators.

Electric thermal

- Industrial heat. $2.1t (global coal industry). Until four years ago, the cheapest heat came from coal, a flammable rock we pick up off the ground and burn. Since then, the cheapest heat is generated by solar PV dumped into resistive heaters, such as those found in ceramic electric kilns. For many industrial processes, electric heaters, which can routinely hit 1400 C with metallic elements, or as high as 1850 C with molybdenum disilicide (MoSi2), are the cheapest way to provide heat. Pure carbon electrodes under inert atmosphere can hit almost 2800 C.

- Thermal energy storage. $88b (US annual heating oil consumption). Unlike batteries, it is already extremely cheap to store heat overnight or even seasonally. Conceptually, a giant pile of slightly electrically conductive bricks connected directly to a solar array can heat up to 1400 C and stay hot for weeks, months, or years. Heat can be cycled out by blowing air through the pile which, if it is large enough, does not even need insulation. Companies developing this tech include Antora, Rondo, and a bunch of others. For communities that endure long cold winters, this method of solar energy storage is probably the cheapest way to heat in winter, unless batteries continue to get radically cheaper. For industrial processes that depend on continuous heat, this is the easiest way to smooth out solar’s diurnal power variations. Several companies have already formed to commercialize thermal energy storage.

- Cement production. $400b, 5% growth. By far the single most CO2-emissive and energy consuming industry is cement production. Humans produce 5 billion tonnes of it per year, a staggering number reflecting the incredible utility of durable, cheap, pour-able liquid stone. We literally build entire cities out of it. While Brimstone is developing a way to produce cement without CO2 emissions, the major cement companies use mostly fully-depreciated plants and are experimenting with electric pre-calcination in Europe. Companies developing high temperature electric kilns for pre-calcination include Leilac, Calix, and numerous others. Part of the difficulty with direct substitution, aside from cost, is that the coal burned to produce cement has small quantities of supplementary cementitious material (SCM) such as gypsum as part of the ash that otherwise has to be substituted. Still, there are a bunch of ways to transition the energy cost of cement onto cheaper solar, including direct electrical heating, local hydrogen production, synthetic fuel, or alternative chemical pathways.

AC electricity

- Grid electricity. $1.6t, 5% growth. Most solar PV today is used to generate alternating current (AC) for conventional grid-based energy consumption, either via rooftop solar or industrial scale solar farms, which have much lower cost of production but much higher distribution costs. Indeed, the primary constraint on solar industry growth today is the grid interconnection queue, itself blocked by regulatory constraints. That said, today solar generates ~6% of global energy, third among renewables behind hydro and wind but by far the fastest growing energy source in history. The industry is relatively well-developed but growing ~30% year over year, so there’s still about a decade left for major disruption on any of several major verticals, including panel manufacturing, solar development, battery manufacturing, battery product development, site construction (EPC) and management.

Electrolysis of water

Solar DC power can be used to split water into hydrogen and oxygen using electrolysis. While this process has been more expensive than steam methane reforming for the last 70 years, solar PV is poised to make a comeback. Adapting electrolyzers to cheap intermittent renewable power will enable green hydrogen below $1/kg in the next few years, which creates the opportunity to disrupt a bunch of enormous legacy chemical processes. Hydrogen itself is a horrible, pernicious molecule that will almost always be used immediately after generation by a reactor built adjacent to the point of hydrogen generation.

- Synthetic fuels. $6.8t, 4% growth. Solar green hydrogen’s largest use case is the catalytic reduction of atmospheric CO2 to produce synthetic hydrocarbon fuel – oil and gas from sunlight and air. Solar synthetic hydrocarbons are poised to undercut drilling as the cheapest source of chemical energy for humanity, while solar is already cheaper energy in the form of electricity and heat. Despite the transformational economic effects of retrofitting the entire supply side of the global hydrocarbon supply chain over the next two decades, relatively few companies, including my own Terraform Industries, Rivan, General Galactic, and Turn2X are aggressively accelerating toward this goal. Every hour, this industry turns over $1b. Half the world’s population suffers from hydrocarbon scarcity. Oil is the antidote to poverty. Synthetic fuels are the only way to increase oil supply, cut prices, and slash strategic and security supply chain issues. Synthetic fuels are the single biggest lever we have to double global economic growth. Unlocking oil supply to raise global oil consumption (5 barrels per person per year) to US levels (22 barrels per person per year) would increase revenue to $30t/year. Solar synthetics lowering prices to induce Texas-level consumption (54 barrels per person per year) increases revenue to $73t/year. A commensurate lift in global GDP to match Texas would increase the size of the economy from $100t to $600t per year. Over 20 years, this averages 9.5% annual economic growth, which is on par with Chinese growth since 1990. We’re going to get back on the Henry Adams curve. Practically, this means we’ll achieve the same economic growth, improvement in standards of living and wealth, and acceleration towards a bright future in a single generation that, at 2020 levels of growth, would take three or four generations.

- Fertilizer. $192b, 4% growth. Half of the world’s eight billion people are fed by plants grown with nitrogen fertilizer, produced in enormous chemical plants using the Haber-Bosch process from nitrogen and hydrogen. First developed more than a century ago, hydrogen was initially sourced from mostly hydroelectric electrolysis, but steam methane reforming of natural gas became more economical after the second world war. This change is set to reverse as solar green hydrogen undercuts methane, creating opportunities to disrupt legacy fertilizer plants with new, solar powered, modular plants that operate in a solar array. It is also possible to produce nitrate via a direct electric process, such as that being developed by Nitricity.

- Plastics. $700b, 2.3% growth. There are thousands of different kinds of plastics used in every facet of our modern world. Plastics are produced from monomers, many of which are derived from ethylene (C2H4), a basic hydrocarbon. Ethylene can be synthetically derived from CO2 and H2 in a variety of different ways, for example CO2 -> CH3OH -> CH3OCH3 -> C2H4. Ethylene, in addition to being the basic monomer for polyethylene, in my top five all time plastics, is also a fuel, anesthetic, and fruit-ripening agent. We produced about 230 million tonnes of it last year. Wood is a kind of bio-plastic produced from sunlight and air, and along with synthetic fuels, it is an economic inevitability that plastics will cut over to synthetic sources in the next 20 years, providing yet another opportunity to disrupt an existing industry and rewrite the rules. Companies in this space include LanzaTech, Circe, Twelve, and numerous others.

- Aviation. Airlines $842b, 5% growth. Aircraft manufacturing $316b, -3% growth. Last year airlines carried 9 billion passengers, though of course fewer than 50 million people fly routinely. Air travel is power law distributed, most humans have still never flown in a plane – to view the Earth as birds and gods. Conventional wisdom on climate change calls for a SAF-excise tax on airlines to subsidize the production of even-more-expensive “sustainable aviation fuel” and make flying even more unaffordable for the masses. In contrast, solar synthetics produce abundant low cost fuels that happen to be carbon neutral, expanding access to the miracle of flight, increasing global connectivity and economic opportunity. Fuel cost is about 15% of ticket price, so lower fuel costs will see increased growth in flight demand. Companies in this space include Dimensional Energy, Lydian, and a bunch of others.

- Supersonic flight. The concord and other SSTs were killed in part by high fuel prices associated with the oil shocks in the early 1970s. Supersonic flight consumes roughly 6x as much fuel to reduce flight times by 2-3x. Synthetic fuels will generate predictable and steady declines in fuel prices, justifying forward-looking investment in next generation jet transport (Boom) and their engines (AstroMechanica), which may end up preferentially consuming LNG instead of Jet A. LNG has 28% higher energy density and cryogenic cooling potential. Together, aviation in 2045 should look like 100 billion passenger flights, of which 10 billion are on supersonic aircraft.

Electrocatalysis

- Mining. $1t/year, 3% growth. While it is possible to use solar electricity to run mining equipment or even zero impact tunnel boring machines, that approach doesn’t take full advantage of the cost savings of cheap solar power. Instead, we can melt arbitrary rocks and electrocatalytically fractionally separate them into each of their constituent metals plus oxygen which, like synthetic fuels, is vented as a byproduct. This approach, which is ludicrously profligate in its use of power, enables the processing of much poorer ores into metals.

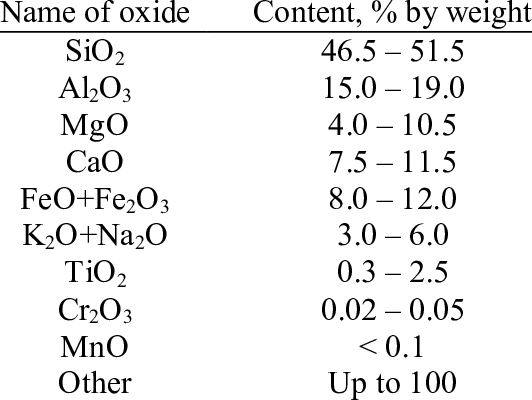

Typical content of basalt, a common, undifferentiated rock not typically used for metal extraction.

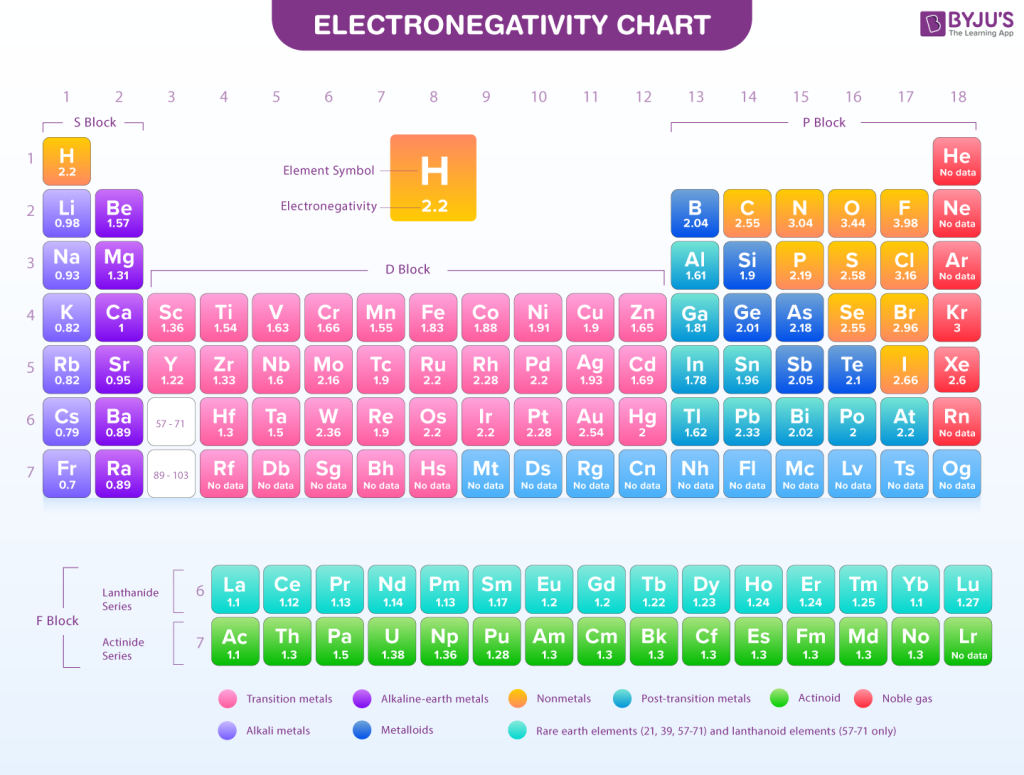

Electronegativity chart shows order that various metals will come out of the molten solution. This production method is similar to aluminum production by dissolving bauxite in molten (synthetic) cryolite, albeit much cruder and much more versatile.

Of course, if you have a concentrated ore there are dozens of electrocatalytic refining techniques in active development, such as the copper process being developed by Still Bright.

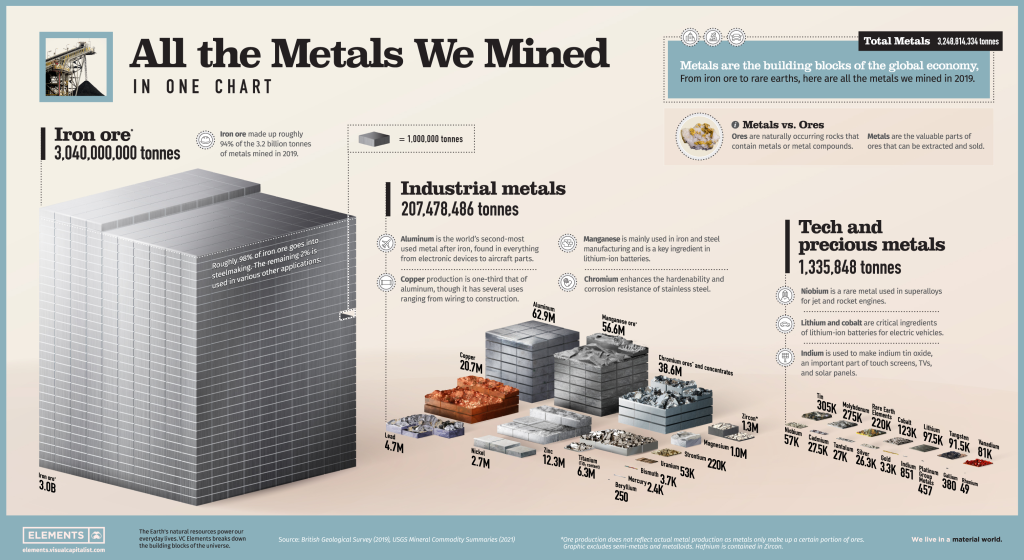

Here’s a great diagram of all the metals we extract. The lion’s share is iron ($1.6t, 4%), and there are a few different ways to process iron.

- Traditionally a blast furnace containing coke and iron ore is run to produce reduced iron.

- It is possible to produce synthetic coke from direct air captured CO2, but unlikely to be cheaper than coal in the short term.

- It is possible to reduce iron ore using hydrogen, which reacts with the oxide to form steam, leaving pure iron behind.

- It is possible to reduce the iron ore electrolytically, which has the advantage of no intermediate hydrogen production step, but also requires the iron ore to be liquefied or dissolved in a conductive medium.

These processes translate analogously to other metals, including aluminum ($150b, 5% growth) already refined electrolytically), chromium ($23b, 5%), copper ($309b, 5%), zinc ($30b, 11%), titanium ($29b, 6%), lithium ($22b, 22%), and all the rare earths ($8b, 9%). Magnesium, which has historically been produced from sea water using the Dow process, is being re-energized by Magrathea.

Silicon ($12b, 6% growth) is refined for electrical applications using the Siemens process, an old fashioned, expensive, and energy intensive method. Our world will have economically-driven robust demand growth for silicon for the foreseeable century and there is a fortune to be made in refashioning the supply chain to exploit cheap solar energy.

- Metal machining. $355b, 7% growth. Most of the world’s mineral ores are found in places with adequate solar resources, such as Australia, to facilitate local development of the enormous solar arrays necessary to perform refining adjacent to the mine site. This is enormously advantageous as it allows the mining entity to add significantly more value to their product before shipping it to market. The next natural step is to concatenate a manufacturing layer to the mining/refining process. We have cheap power, plenty of space, a skilled workforce, advanced robotics, so why not set up a versatile machine shop (such as Hadrian) between the mine and the nearest port or airport and export high value finished parts rather than metal bars or raw ore? Xometry and PCBWay are already pioneering manufacturing on-demand business models, the next obvious step is to collocate these factories with the mining regions that produce the source metals, and where off cuts and swarf can be easily recycled.

- Chemicals. $5.7t, 8% growth. The chemical industry is supported by hydrocarbons and hydrogen, which can be trivially cut over on the supply side as described above. It is also possible to make many chemicals via direct electrocatalysis, given sufficiently advanced catalysts, such as those being developed by Twelve among many others.

- Recycling. $58b, 7% growth. Today’s recycling industry attempts to sort recyclable materials into dozens of different streams that can be refashioned into new products with minimal energy consumption. But in a world of cheap solar, it may ultimately be more economical to remember that all matter is made of atoms, and most of it from just a few different kinds of atoms. If we break all the chemical bonds through extreme heat, we can then separate the atoms out by mass using a mass spectrometer or, more boringly, through the fractional electrocatalytic deposition process described above.

- Matter compilers. Global retail is $30t, 9% growth. Being able to turn any form of matter whether trash or random rocks into a stream of pure separated atoms is only half the battle. Re-assembling them into any desired configuration currently requires a globe-spanning techno-capital machine composed of tens of thousands of factories and hundreds of millions of skilled workers. But if we could pick and place them quickly enough, with some kind of matter compiler, we could radically compactify the industrial stack and allocate capital elsewhere. This is the most extreme form of the general robotics industry, which otherwise enables conventional albeit significantly or fully automated manufacturing through the use of humanoid and industrial robots, such as Optimus or Atlas.

This brings us to the close of our brief tour through the various energy intensive industries. More or less extreme changes to these processes are indicated by the emergence of extremely cheap solar power. These changes present infinite possibilities for disruption of the large, risk averse, growth averse incumbents. The incipient emergence of solar cheaper than fossil fuels is probably the last opportunity to reshuffle the deck in terms of ownership of these various means of production, and represents a unified, industry wide investment thesis with unlimited capacity for outsize returns in response to technical innovation.

Let’s build!

Brilliant summary of opportunities – and I know you have dozens more use cases including compute – thanks for another fantastic 25-year scan Casey, love your work!

Question: how far do you think we are from a scale 12-hour battery capability to complement Solar & accelerate the transition to a DER (Distributed Energy Resources)-based grid?

LikeLike

We can do it today.

LikeLike

Wow. I hope we don’t kill each other or starve because of the climate change before all of this becomes a reality.

LikeLike

food production- e.g. Solein protein from electricity and air

LikeLike

This is the attitude human civilization should have towards the future. Let’s build it.

LikeLike

You might want to add Liquid Wind to your list of synthetic hydrocarbon players. They are actually building a full scale plant.

LikeLike

Awesome – I think I focused on DAC CO2 companies because biogenic sources will run into scaling problems, but they might be CO2 source agnostic.

LikeLike

timeline for climate change (without the hysterics) is on the order of hundreds of years, the changes Casey is describing will occur over decades.

likely we will have to agree on an atmospheric CO2 level since a lot of advanced solar applications will become net carbon sinks (an example is greening the Sahara)

LikeLike

Imagine that vast surfaces of the planet are covered in solar panels as you predict. Do you believe that the heating effect due to the decrease in albedo would prevail on the temperature, causing it to rise (solar panels are, after all, dark, and therefore heat up under the sun more than the unspoiled land they shade) or that the cooling effect due to the reducing of co2 emissions on a global scale will prevail? Most importantly, have any calculations been made in this regard? I ask this because the dominant way of thinking today uncritically claims that a widespread use of renewable energy has a mitigating effect on the planet’s temperature, and should be therefore subsidized.

And, in addition to this, do you believe that a 10x increase in energy production and use on a global scale won’t be capable of moving the planet’s temperature upwards as a mere warming effect of a stove in a room? Do you believe that climate-modifying technologies will be necessary to adopt in the world you see coming?

LikeLike

It’s a good question. I think while full scale out of solar will reduce Earth’s albedo by about 0.1%, it will also improve moisture retention and plant growth in those areas, and hot plants produce isoprene, which reflects light back into space, at least partly offsetting this trend.

LikeLiked by 1 person

I think you’ve missed an opportunity (maybe too far out?) where we grow food using the matter compilers. It’ll have to compete with vats of bacteria (or maybe they complement each other?) but conventional agriculture is doomed in the long term.

LikeLiked by 1 person

Yes – I’m with you on that! Precision Fermentation basically divorces the solar collection area for food from arable land to anywhere you can cheaply stick solar panels. Also – photosynthesis is only 6% efficient – and by the time you extract the bit of the plant you can eat – maybe 1% efficient. Then if you feed that plant to animals for protein, it gets even worse. But stick solar panels which are nearly 4 TIMES as efficient as photosynthesis on rooftops, float them on water reservoirs, or brownfields or out in deserts – and we can grow all our food without arable land. I did the maths once – and at a rough conservative estimate we could just let nature regrow trees across the 2 BILLION hectares we’ve cut down for grazing alone! (Not replacing all our crops – just grazing for animals – 30% of the land on earth.) That’s about 3 TRILLION trees – enough carbon to lock up all our historical industrial emissions. If we let some ecosystems scientists and biologists supervise what trees grow back across that area – we may just provide abundant habitat for many threatened species. That’s climate change REVERSED, the human race fed and the biosphere restored! So count me in. I’m a fan!

LikeLike

Solar PV is 100-1000x more energy productive than agriculture, depending on crop, soil quality, and end use form.

LikeLike

A nitpick while I think about this:

LikeLike

Has anybody done a back-of-napkin on how much energy it would take to ground a glacier by refrigerating its base?

Even after we get to carbon neutrality, it seems like climate change mitigation is going to be a huge consumer of energy.

LikeLike

not if you sprinkle some sulfur over the stratosphere

LikeLike

You’re not going to remove petajoules of heat from the grounding line with a small air temperature shift. If a bunch of glaciers slide into the ocean, the sea level rise does enormous damage. But if can freeze the grounding line, you might be able to stop that.

LikeLike

Hi – a friend put me onto this awesome post and there is so much to digest! One comment on concrete. With the arrival of Cross Laminated Timber we can now build skyscrapers out of wood – removing concrete from the slabs of each floor and limiting it to the foundations. CLT is strong as steel but 5 times lighter, and while the material is more expensive – the products are prefabricated off site and the building process uses far less labour. So the building process is faster and cheaper – and the fire safety is BETTER than steel! https://eclipsenow.wordpress.com/tall-timbers/

I wish I had the time to work out how much concrete that would cut out of our use? They are even talking about CLT now bringing wood as a building material back to bridges. https://woodrandd.com/timber-bridges/ I understand a lot of American infrastructure is due for a rebuild or refit. I hope the right materials are chosen to lock up carbon instead of release it!

LikeLike

My understanding is that US solar panel production, and even all non-Chinese solar panel production together, is dwarfed by Chinese solar panel production. To what extent is the rapid decline in cost for solar panels a function of Chinese production, and what happens to projections for these energy-intensive industries if there is disruption to the Chinese supply?

LikeLike

Not much, China uses Western tech and tooling, and at current growth rates, any country could be ahead in 5 years.

LikeLike

Interesting point on that, do you reckon the Australian Federal Govt’s plan to build a solar industry here has a realistic chance of taking a significant chunk of the global pie?

LikeLike

There’s an Australian plan to do solar mass manufacturing in Australia?

LikeLike

I was thinking of the $1bn solar sunshot stuff announced in March. I had thought it was more than that tbh, I don’t see $1bn being enough to make Australian made panels particularly competitive.

LikeLike

Very insightful! Do you think that establishing the industrial infrastructure to manifacture a massive amount of solar panels (and all the raw materials needed to build them for anything that doesnt have geographic constraint such as mining) is dobale, in the current context of global competiton on price and ressources, in any large western state by the logic of freemarket/capitalism alone, or do we need a massive state led strategy and policies (such as what the chinese have done maybe?) ? Other question are you at all concerned about waste management on the long term for solar such as the effects of decaying solar panels on site in larges aeras of natural land? Will recycling be economically advantageous vs dumping and buying new?

LikeLike

No need for state-led strategy, this is capitalism at work.

Not concerned about waste management.

Recycling? Maybe? But I think there are probably better things to recycle.

LikeLike

I worry how a 5-year pause – or reversal – in the decreasing cost of solar panels could affect Terraform Industries and others. It makes sense that the US could ramp up in 5 years, but would we? Is there a meaningful focus in the US, by either government or industry, to ensure a supply of panels with decreasing price on a meaningful timeline? If not, does the dependence of Terraform Industries, and the other industries you describe, on low-cost solar represent a critical bottleneck to prioritize?

LikeLike

Unlike AI or Crypto, it seems to mean that the lions share of the value to be captured will be taken by incumbents. You can’t really displace huge cement or fertilizer manufacturers as a startup.

I’m looking forward to seeing how Terraform Industries does against the big Oil Companies in the coming decades.

LikeLike

Michael Barnard has an interesting piece on why Brimstone’s alternative rocks would make concrete very, very expensive. Sadly – I wish it were otherwise.

https://cleantechnica.com/2024/05/24/brimstones-cement-process-tries-to-dodge-carbon-dioxide-through-costlier-rocks-higher-heat/

LikeLike

This is one of my all time favorite posts of yours, thank you!

What industries are you especially bearish on assuming solar and battery learning rates hold for the next 20 years?

Also, would love to see a similar article as this one on the investment opportunities given Starship success. The more commercial version of your science article here: https://caseyhandmer.wordpress.com/2021/11/17/science-upside-for-starship/.

LikeLike

Coal mining and oil drilling for one. Also bearish on mass production of internal combustion engines and parts.

LikeLike